LED linear lighting has transformed commercial and industrial spaces with superior energy efficiency and design flexibility. The market now features dozens of manufacturers offering varying quality levels and specifications.

We at PacLights understand that choosing the right LED linear lighting manufacturers requires careful evaluation of performance metrics, certifications, and application compatibility. This guide examines leading manufacturers and the key factors that separate premium products from budget alternatives.

Which LED Linear Lighting Manufacturers Lead the Market

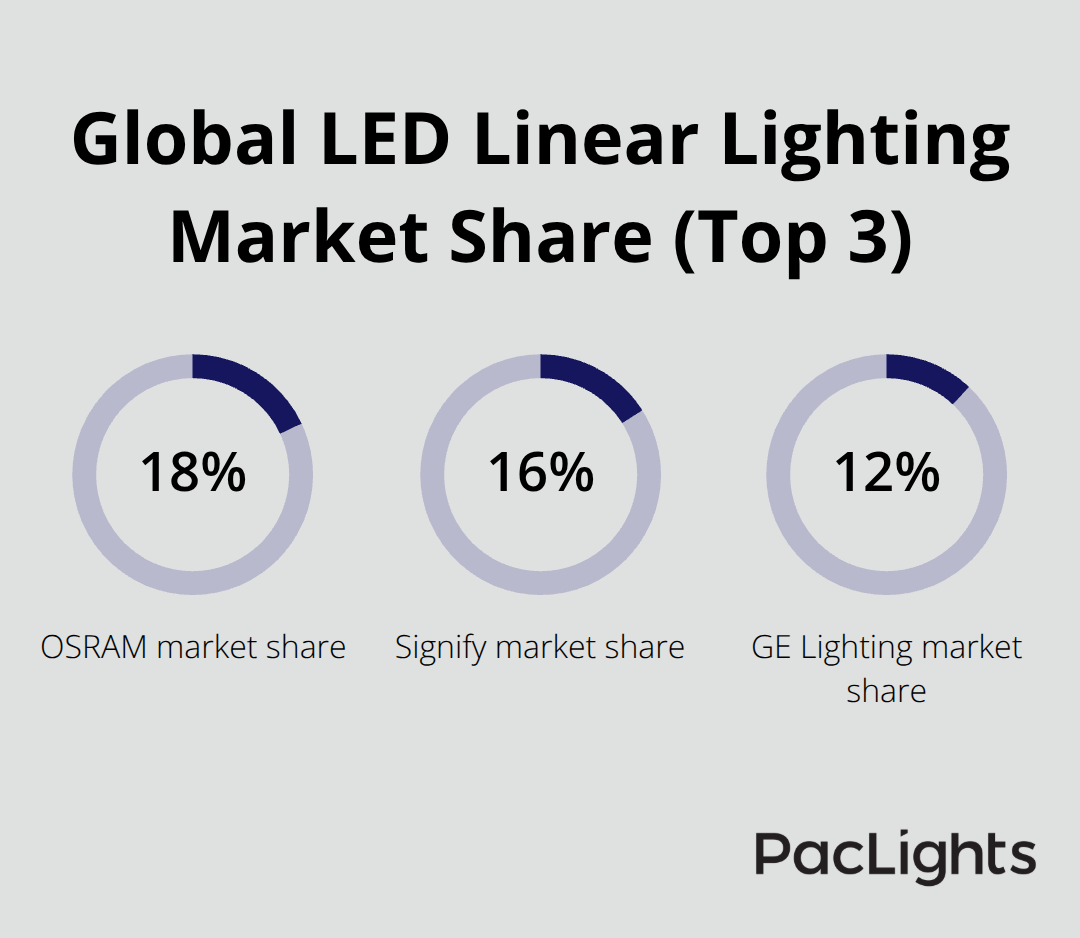

OSRAM dominates the global LED linear lighting market with approximately 18% market share, followed by Signify at 16% and GE Lighting at 12%. These three manufacturers control nearly half of the worldwide market through their extensive distribution networks and decades of lighting expertise.

Market Leaders and Their Strengths

OSRAM, founded in 1919, specializes in high-performance LED linear modules with luminous efficacy that exceeds 190 lm/W. Signify focuses on smart lighting integration with their Interact platform, while GE Lighting has carved out a strong position in North American commercial markets with their Current brand linear systems. Each manufacturer brings distinct advantages to different market segments.

Premium Segment Specialists

Zumtobel and ERCO represent the premium segment, with both companies achieving CRI ratings above 95 for their linear products. Zumtobel’s Tecton system offers modular linear lighting with precise beam control, making it the preferred choice for museums and galleries where color accuracy matters most. ERCO’s Quintessence linear system delivers exceptional uniformity with SDCM values below 2 (commanding premium pricing but delivering superior performance).

Smart Building Integration Leaders

Acuity Brands has gained significant traction in smart building applications, with their nLight platform controlling over 2 million LED fixtures across North America. This manufacturer focuses heavily on IoT integration and advanced control systems that adapt to occupancy patterns and daylight levels.

Essential Quality Standards

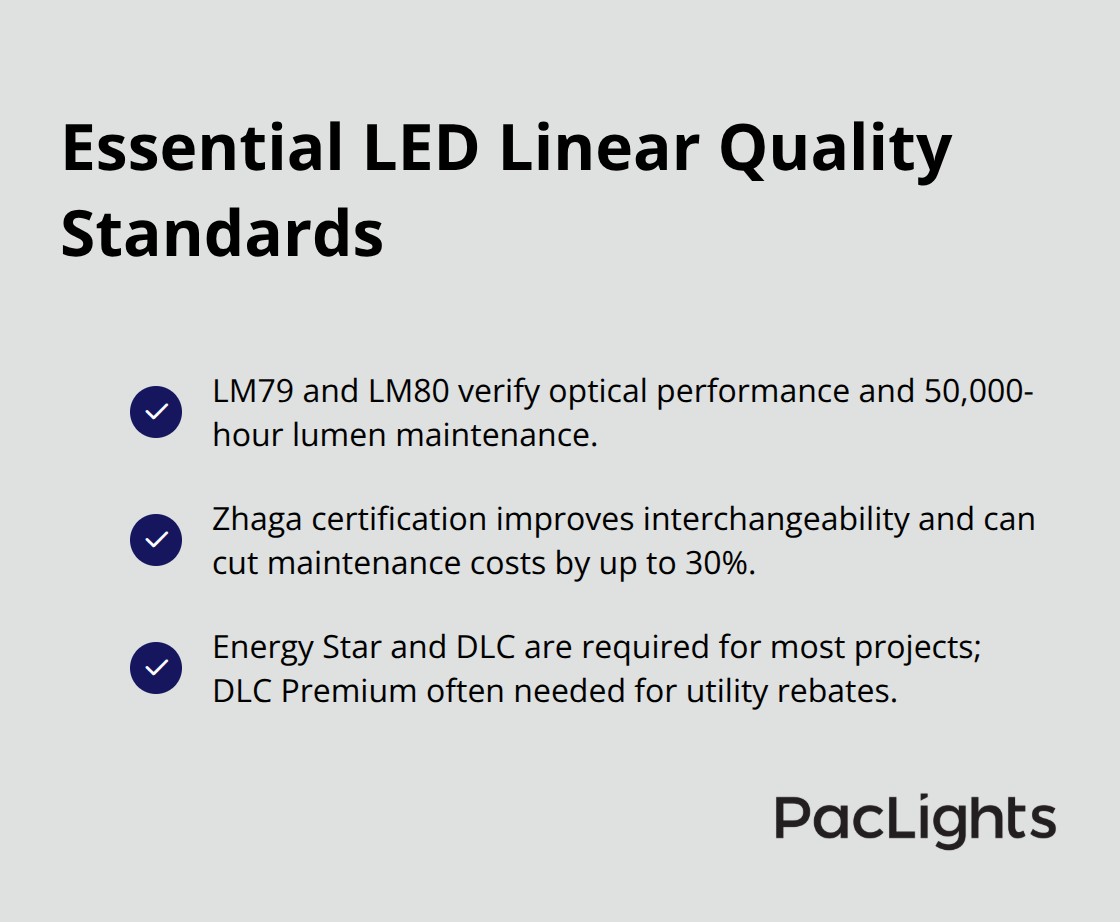

Manufacturers with LM79 and LM80 certification compliance validate optical performance and lumen maintenance over 50,000 hours. Zhaga Standard certification becomes increasingly important for interchangeability between different manufacturers’ modules, reducing long-term maintenance costs by up to 30%. Energy Star and DLC certifications are mandatory for most commercial projects, with DLC Premium qualification often required for utility rebates.

These quality standards directly impact the performance characteristics you should evaluate when selecting LED linear lighting systems for your specific applications.

Key Features to Look for in LED Linear Lighting

Energy efficiency separates premium LED linear lighting from budget alternatives, with top manufacturers achieving 150-190 lm/W while basic models struggle to reach 120 lm/W. This 40% efficiency gap translates to substantial operational savings over the 50,000-hour lifespan typical of quality LED modules.

Premium manufacturers like OSRAM and Signify consistently deliver luminous efficacy above 180 lm/W, making their products worthwhile despite higher upfront costs. The Department of Energy data shows that high-efficiency LED systems reduce energy consumption by up to 80% compared to fluorescent alternatives, with payback periods typically under three years for commercial installations.

Color Temperature Range and Accuracy Standards

Color temperature flexibility between 2700K and 6500K allows adaptation to different environments, but CRI ratings above 90 are non-negotiable for retail, healthcare, and educational applications where color accuracy affects productivity and safety. Manufacturers that offer SDCM values below 3 provide the color consistency needed for large installations, preventing the patchy appearance that cheaper products create.

Zumtobel and ERCO consistently achieve CRI ratings above 95, while budget manufacturers often fall short at 80-85 CRI (creating noticeable color distortion under close examination). This performance gap becomes particularly evident in spaces where accurate color representation directly impacts business outcomes.

Advanced Control and Dimming Options

DALI dimming capability has become the commercial standard, with 0-10V dimming acceptable only for basic applications. Smart control integration through platforms like Casambi or Acuity’s nLight enables occupancy sensing, daylight harvesting, and energy monitoring that can reduce consumption by an additional 20-30% beyond LED efficiency gains.

Manufacturers that provide wireless mesh networking capabilities future-proof installations against evolving building automation requirements. Those limited to hardwired dimming create costly upgrade challenges when buildings require more sophisticated control systems.

Thermal Management and Longevity Factors

Effective thermal management directly impacts LED performance and lifespan, with aluminum heat sinks being the most reliable solution for maintaining consistent light output. Quality manufacturers design their linear modules with thermal pathways that keep junction temperatures below 85°C (ensuring the full 50,000-hour rated life).

Poor thermal design leads to accelerated lumen depreciation and color shift over time. Premium manufacturers validate their thermal performance through LM80 testing, while budget alternatives often skip this verification step.

These performance specifications become even more important when you consider the specific mounting and installation requirements for different commercial applications.

Applications and Installation Considerations

Commercial office spaces require 500-750 lux according to workplace lighting regulations, which makes LED linear lighting the optimal choice for conference rooms and open office areas where fluorescent fixtures previously dominated. Retail environments demand higher light levels of 750-1500 lux to properly display merchandise, with linear systems providing the precise beam control needed to highlight products without creating unwanted shadows or glare. Industrial facilities benefit most from linear lighting in assembly areas and quality control stations where consistent illumination across work surfaces directly impacts productivity and safety compliance.

Structural Requirements for Different Installation Types

Suspended linear installations require structural support capable of handling 2-4 pounds per linear foot, with mounting heights between 8-12 feet providing optimal light distribution for most commercial applications. Recessed installations demand 6-8 inches of plenum space above the ceiling, which makes them unsuitable for older buildings with limited cavity depth. Surface-mounted options work best when existing infrastructure cannot accommodate recessed or suspended systems (though they create more visual impact and require careful architectural integration to avoid an industrial appearance).

Control System Integration Challenges

DALI control systems integrate seamlessly with most modern building automation platforms, while older 0-10V dimming systems require additional interface modules that add $200-400 per control zone to project costs. Existing emergency lighting circuits often cannot support LED linear systems without electrical upgrades, as most legacy emergency ballasts are incompatible with LED drivers. Power requirements typically drop by 60-70% when replacing fluorescent linear systems with LED equivalents, creating opportunities to add additional lighting circuits without electrical service upgrades.

Smart Building Compatibility Factors

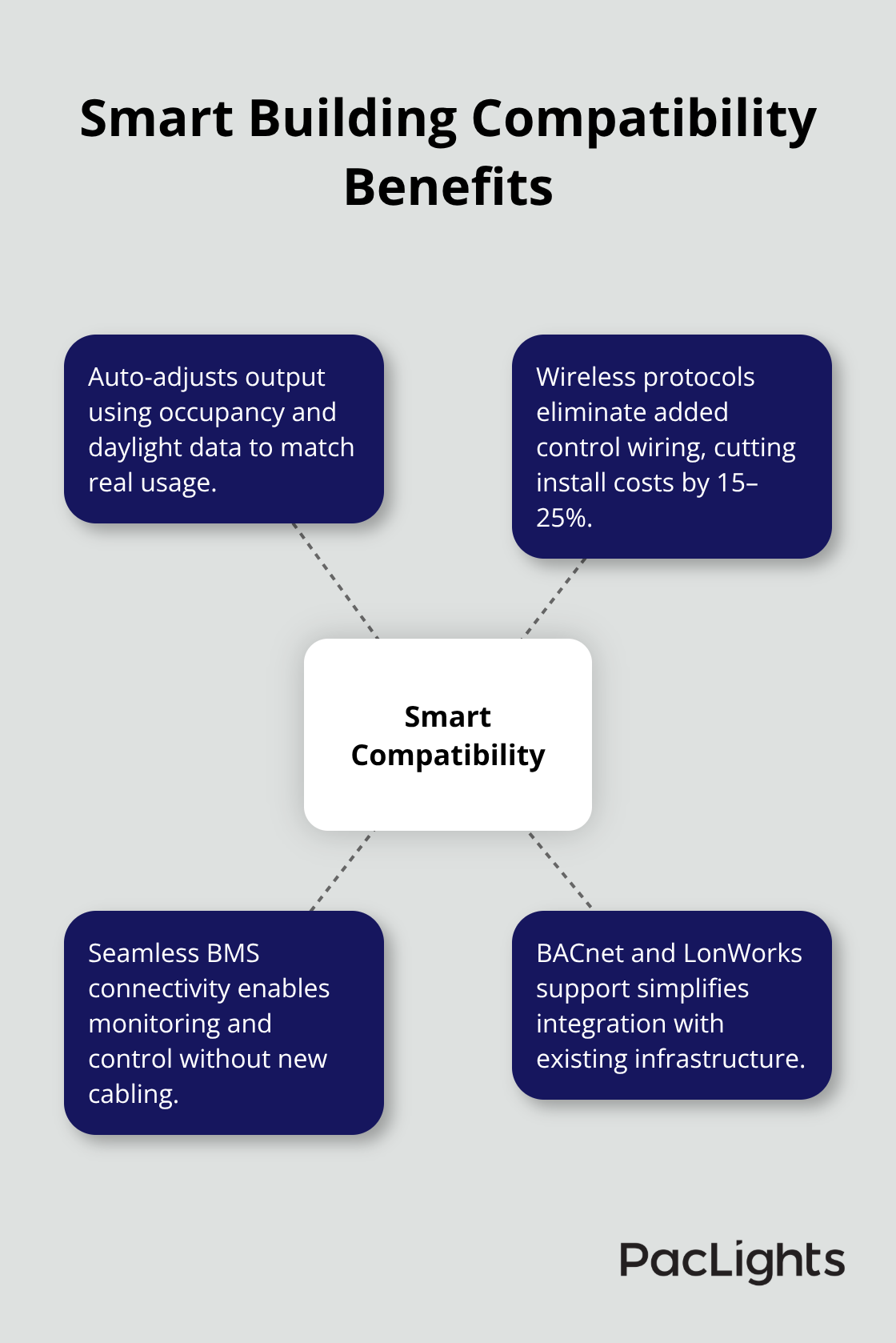

Smart building integration becomes particularly valuable in facilities with existing occupancy sensors and daylight harvesting systems, where LED linear lighting can automatically adjust output based on actual usage patterns and available natural light. Modern LED linear systems communicate with building management systems through wireless protocols that eliminate the need for additional control wiring (reducing installation costs by 15-25% compared to hardwired alternatives). Facilities with existing BACnet or LonWorks networks can integrate LED linear lighting without major infrastructure changes.

Final Thoughts

OSRAM, Signify, and GE Lighting represent the safest choices for large commercial projects, with proven track records and comprehensive warranty support. Zumtobel and ERCO excel in premium applications where color accuracy and beam precision justify higher costs. Acuity Brands leads smart building integration with their nLight platform that controls over 2 million fixtures.

Office environments that require 500-750 lux benefit from LED linear lighting manufacturers who offer DALI dimming and CRI ratings above 90. Industrial facilities perform best with systems that achieve 180+ lm/W efficiency with robust thermal management. Retail spaces demand precise beam control and color consistency with SDCM values below 3 (which only premium manufacturers consistently deliver).

The LED linear lighting market continues to evolve toward wireless mesh networks and AI-driven occupancy sensors. Smart systems now reduce energy consumption by an additional 20-30% beyond basic LED efficiency gains. We at PacLights offer comprehensive LED lighting solutions with advanced controls and retrofit options that help facilities optimize their investments while reducing operational costs through energy-efficient systems.

Disclaimer: PacLights is not responsible for any actions taken based on the suggestions and information provided in this article, and readers should consult local building and electrical codes for proper guidance.